Market Recap – Week ending June 2

Jobs Data, Debt Ceiling Bill Help Push Stocks Higher

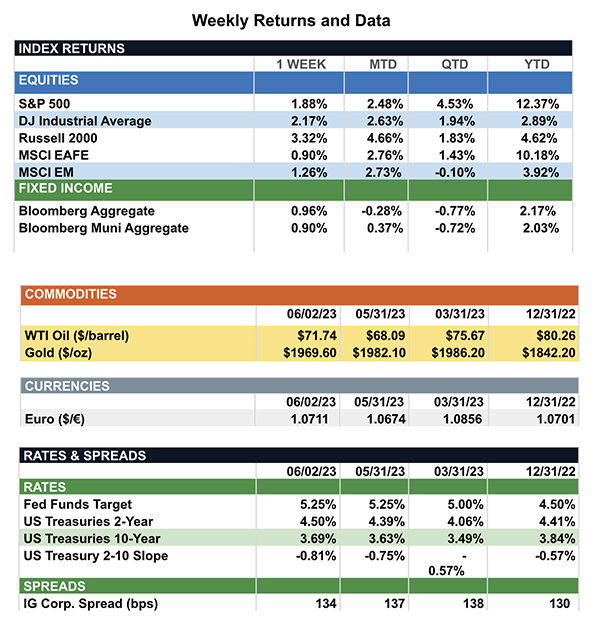

Overview: Stocks across the globe were higher last week, led in the U.S. by the best performance since March for the S&P 500 index, which was higher by 1.9%. Markets were encouraged by the passage of the bill to raise the debt ceiling, passed ahead of the June 5 deadline suggested by Treasury Secretary Janet Yellen. In addition, strong jobs data helped buoy the markets with nonfarm payrolls rising by 339,000, well ahead of the consensus of 195,000 new jobs. The labor market continues to be resilient, with actual numbers for jobs increases beating the consensus for a record 14 months in a row. Meanwhile, the unemployment rate increased from 3.4% to 3.7%. Labor strength continues to be supportive of growth as markets hope a recession can be avoided as the Federal Reserve continues to battle inflation. We now expect the Fed to keep the funds rate at the current level of a range of 5.00%- 5.25% at their upcoming meeting June 13-14, but would not rule out future increases depending on the strength of economic data in the upcoming months. Futures markets, according to Fed Watch data, now are expecting funds rates to finish the year at around the current levels. In the bond markets, the 2-year and 10-year Treasury notes have adjusted higher in yield to reflect these higher rates for longer expectations, finishing the week at 4.50% and 3.69%, respectively.

Update on the Labor Market (from JP Morgan): Last week, investors received a large bundle of data related to the jobs market. There is some indication of future weakness but, overall, the jobs data mosaic points to normalization at a gradual pace. The May employment report showed a net creation of 339,000 jobs, above expectations and an uptick compared to April’s 264,000. Some signs of softness included a move higher of 0.3% in the unemployment rate to 3.7%. In addition, wage growth eased to 0.3% m/m, bringing the year-over-year rate down to 4.3%. The April JOLTS data also was mixed: job openings were surprisingly high, moving up to 10.1M, the first increase this year and still significantly above the 2019 average. On the other hand, the quits rate fell to 2.4%, its lowest level since February 2021, edging closer to the 2019 average. This signals that workers feel less comfortable leaving their jobs or the quality of jobs available is potentially declining. Overall, the labor market is showing signs of stabilization rather than weakness, bolstering the possibility of a soft landing. Historically, spikes in unemployment have significantly lagged the onset of rate hikes. However, given the speed and intensity of the recent tightening regime, it would not have been surprising to see a greater rise in jobless claims and layoffs already taking shape. The labor tightness created by the pandemic recovery may be helping the job market avoid any sudden drop-offs. We think recent data supports a Fed pause at the June meeting, as it waits to see which way the labor market data breaks: normalization or a bigger slowdown.

Sources: JP Morgan Asset Management, Goldman Sachs Asset Management, Barron’s, Bloomberg

This communication is for informational purposes only. It is not intended as investment advice or an offer or solicitation for the purchase or sale of any financial instrument.

Indices are unmanaged, represent past performance, do not incur fees or expenses, and cannot be invested into directly. Past performance is no guarantee of future results.