Market Recap – Week Ending 07.15.22

Market Recap – Week ending July 15

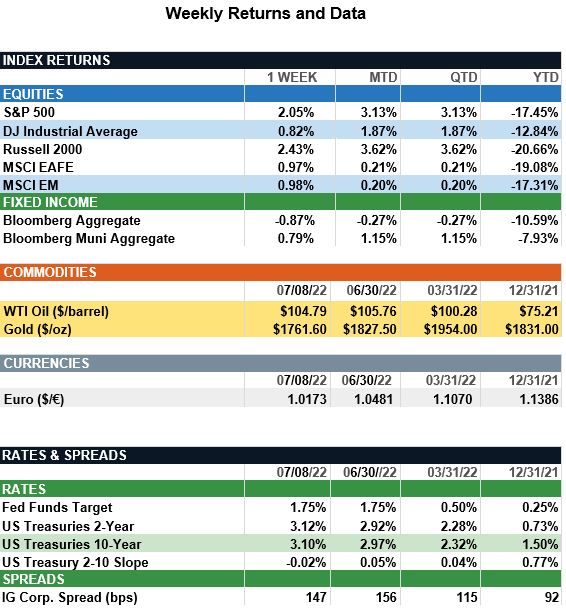

Overview: Despite a strong rally on Friday, stocks traded in negative territory last week as higher-than-expected inflation data added to concerns about aggressive rate hikes by the Federal Reserve. In the U.S., the S&P 500 index fell 0.9%, while international developed (MSCI EAFE) and emerging markets (MSCI EM) were down 1.8% and 3.7%, respectively. U.S. headline consumer prices (CPI) increased 9.1% year-over-year in June, above expectations of 8.8%. In the bond markets, recession fears and market worries about rates hikes have led to a further inversion of the yields. Over the past week, the 10-year Treasury fell 0.17% to 2.93%, while the 2-year rose in yield to 3.14%. In economic data, markets reacted positively on Friday as retail sales rose 1.0% in June, above consensus estimates. This week, focus will be on corporate earnings and housing and manufacturing data, as investors evaluate the health of the consumer ahead of the first estimate of second-quarter gross domestic product (GDP), due to be released on July 28. Focus next week will be on the Federal Reserve meeting July 26-27, with markets now pricing in about a two-thirds probability of a 75-basis-point (0.75%) rate hike and an expectation of an ending funds rate of around 3.5% by year-end 2022.

Update on Inflation(from JP Morgan): If trends continue, June may mark the last hot month of headline inflation, with stickier components taking the baton going forward. This should provide some inflation relief to the Fed and consumers. While markets were anticipating a hot headline CPI reading, the June CPI report showed even hotter-than-expected inflation, with core inflation most surprisingly exceeding expectations. Headline CPI rose by 1.3% m/m and Core CPI rose 0.7% m/m, translating to year-over-year gains of 9.1% and 5.9%, respectively. Sharply higher energy and food prices once against propelled headline inflation higher, while within core inflation, the lagged “bad news” of higher costs of inputs and labor is broadly pushing prices higher. We still expect the Fed will hike interest rates by another 0.75% later this month. Thereafter, the broad-based impact of higher food and energy prices across core components may add pressure on the Fed to hike interest rates even further this year. On the bright side, we see promising signs of inflation coming off its highs in July. Oil and gas prices have dipped meaningfully (down 11% and 4% from June), as have airline fares (down 8%), and this should lead to a deceleration of price pressures in the coming months. Consumer 1-year and 5-year inflation expectations also came down in the University of Michigan’s preliminary July results, dropping from 5.3% to 5.2% and from 3.1% to 2.8%, respectively. If these trends continue, June may mark the last hot month of headline inflation, with stickier components taking the baton going forward. This should provide some inflation relief to the Fed and consumers. However, the question remains whether the Fed will exercise the patience for this lagged “good news” to flow through, or race to stomp out demand before it does.

Sources: JP Morgan Asset Management, Goldman Sachs Asset Management, Barron’s, Bloomberg.

This communication is for informational purposes only. It is not intended as investment advice or an offer or solicitation for the purchase or sale of any financial instrument.

Indices are unmanaged, represent past performance, do not incur fees or expenses, and cannot be invested into directly. Past performance is no guarantee of future results.