Market Recap - Week Ending Dec. 15

Stocks Continue to Rally; Inflation Expected to Show Continued Progress

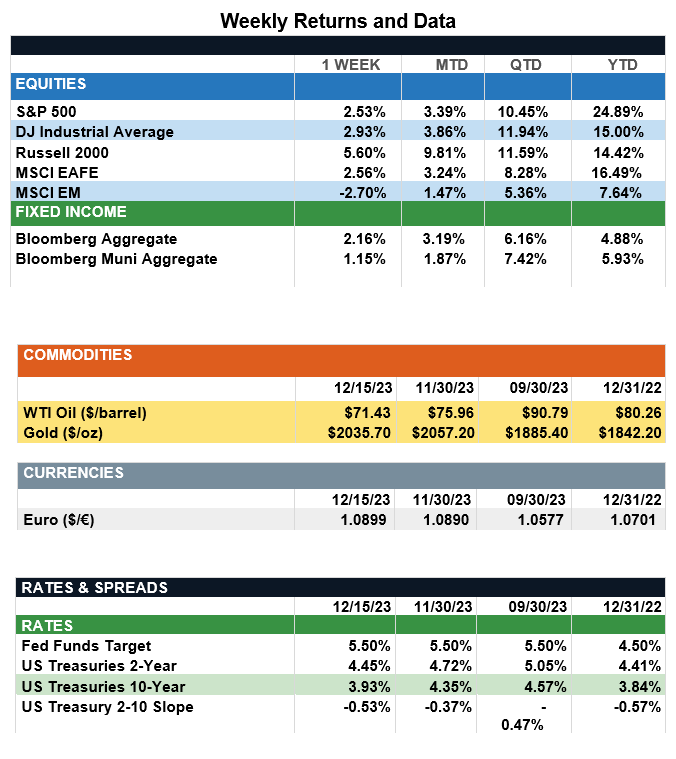

Overview: Stocks across the globe continued to rally last week as major central banks left policy rates unchanged against the backdrop of cooling inflation. In the U.S., the S&P 500 index rallied more than 2.5%, while the Dow Jones Industrial Average reached a new all-time high. Small cap stocks caught a bid higher as well, with the Russell 2000 gaining more than 5% on the week. Overseas, the MSCI EAFE (international developed index) rallied about 2.5%, while emerging market stocks improved by more than 2.7%. Lower interest rates continue to be the primary catalyst behind this relentless rally, as the yield on the 10-year Treasury note has fallen from 5% in late October to less than 4% today. According to the Fed’s most recent summary of economic projections, the central bank now expects to enact as many as three rate cuts in 2024. This came as part of the FOMC’s prepared remarks following the conclusion of their policy-setting meeting on Wednesday of last week, where Fed officials voted unanimously to leave short-term rates unchanged at a target range of 5.25% - 5.50%. This came after key inflation data last week, where U.S. CPI increased 0.1% month-over-month in November and was up 3.1% from a year prior. U.S. core CPI in November increased 0.3% MoM, in line with consensus expectations. U.S. Producer Prices (PPI) on the other hand were soft, remaining unchanged in November on the back of recent declines in energy prices. Looking forward to the rest of the week, we expect investors to pay close attention to key inflation readings from the Eurozone and the UK early this week, followed by PCE readings in the U.S. on Thursday where inflation is expected to show continued progress.

Update on Federal Reserve Policy (from JP Morgan): Last week’s retail sales report surprised to the upside, with total retail sales increasing 0.3% m/m on a seasonally adjusted basis in November. Excluding auto and gas, retail sales increased 0.6% m/m, up from 0.1% growth in October. Sales at gasoline stations decreased 2.9% due to falling energy prices. Auto sales rebounded 0.5% after falling 1.1% the prior month. Elsewhere in the report, sales in food services, furniture, health & personal care, and sporting goods all increased, while sales in electronics & appliances and building materials both decreased, demonstrating consumers’ continued preference for services. Importantly, sales in the control group, which includes the categories used to calculate GDP, increased 0.4% in November, above expectations and up from a flat reading in October. As a result, GDP estimates for Q4 were revised upwards. The Atlanta Fed’s GDPNow model is currently projecting real GDP to grow 2.6% q/q in 4Q23, up from its estimate of 1.2% a week prior. In addition, healthy retail sales data along with a favorable headline CPI reading, a cooler than expected PPI report, and the FOMC’s dovish pivot should similarly augur well for profits in Q4. Moderate CPI and PPI and the prospect of lower rates next year should support margins, while solid retail sales may defy companies’ gloomy expectations for consumer demand noted in 3Q earnings calls.

The slew of favorable data and a dovish FOMC meeting also led markets to rally last week, as investors become increasingly hopeful of a “soft landing.” Looking ahead, markets should continue to find support over the near term; however, as we move deeper into 2024, the path forward for markets may be bumpier, particularly as economic growth slows to below trend and inflation remains above 2%.

Sources: JP Morgan Asset Management, Goldman Sachs Asset Management, Barron’s, Bloomberg, CNBC

This communication is for informational purposes only. It is not intended as investment advice or an offer or solicitation for the purchase or sale of any financial instrument.

Indices are unmanaged, represent past performance, do not incur fees or expenses, and cannot be invested into directly. Past performance is no guarantee of future results.